Frugal Living Mastery: Embrace Simplicity and Thrive in the USA

Anúncios

**Exploring the Art of Frugal Living in America: A Practical Guide**

Living frugally in the USA has become a necessity for many, given the rising costs of living. Embracing frugality doesn’t mean sacrificing comfort or quality, but rather focusing on value-driven choices. Understanding how to navigate this financial path can lead to a satisfying lifestyle that prioritizes needs over wants. This guide offers insights into adopting a cost-effective lifestyle without compromising enjoyment.

The concept of frugal living revolves around smart financial habits. It involves consciously reducing unnecessary expenses and maximizing the value of every dollar spent. The strategy encourages individuals to enjoy meaningful experiences while maintaining financial stability. Embracing frugality doesn’t imply deprivation but rather a strategic approach to spending, allowing for a rich life within one’s means. The essence of frugality lies in mindful spending that aligns with personal values.

Anúncios

In America, frugal living has evolved into a lifestyle choice for those seeking financial freedom. It involves making informed and purposeful spending decisions to stretch resources while fulfilling all necessary obligations. Instead of a restrictive lifestyle, it offers a pathway to sustainable financial health, encouraging conscious consumer behavior. Learning to manage finances effectively is key to ensuring that frugality becomes an enriching aspect of daily life, shaping a future of financial security and well-being.

A Comprehensive Overview of Frugal Living in America

Frugal living in America is about much more than saving money by cutting corners. It’s a holistic lifestyle philosophy, where every financial decision is a step towards a larger goal of financial independence. Prioritizing essential over non-essential spending is a fundamental principle. This approach allows individuals to make purchases that align with their long-term goals. It’s not deprivation but rather a means of creating financial margin.

Budgeting plays a crucial role in adopting a frugal lifestyle. Without a structured financial plan, it’s challenging to pinpoint where expenses can be minimized. Implementing budgeting tools and methods such as the 50/30/20 rule helps create a balance between essentials, leisure, and savings. The goal is to achieve financial health and flexibility without feeling restricted. Tracking expenses offers insights into spending habits, identifying areas in need of adjustment.

Anúncios

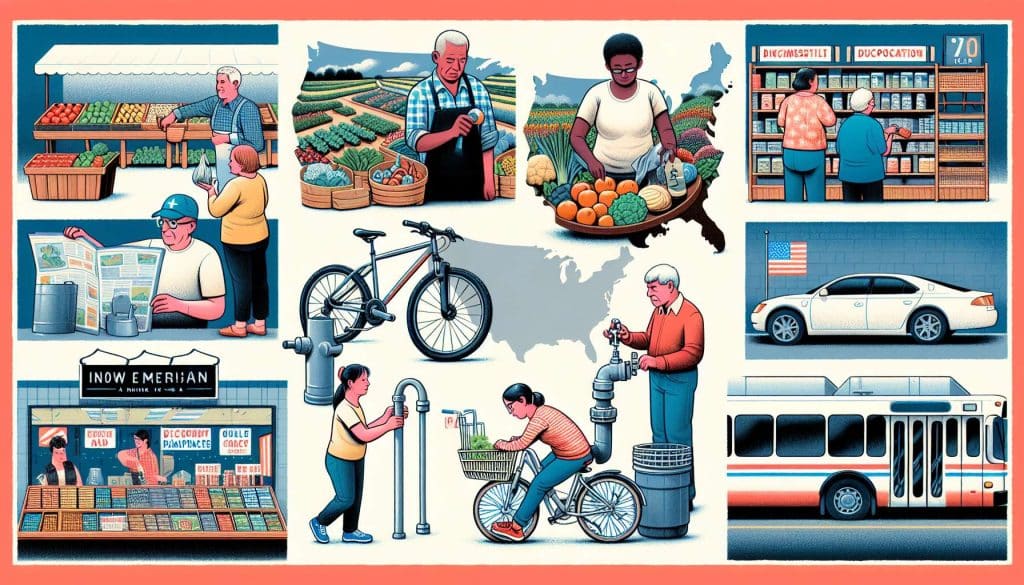

A significant aspect of frugal living is managing everyday expenses such as grocery shopping. Savvy strategies like meal planning and bulk purchases help cut down costs efficiently. Searching for discounts and deals further enhances savings. Shifting focus to value rather than quantity leads to a more sustainable way of living. Choosing locally sourced produce can also support savings while fostering community growth.

Reducing utility bills forms another pillar of frugal living. Simple actions like investing in energy-efficient appliances or using programmable thermostats can lead to noticeable savings. Additionally, being mindful of energy consumption by turning off unused devices can significantly impact financial health. These efforts contribute to an eco-friendly lifestyle, which enhances the quality of time spent at home.

Frugal entertainment options encourage creativity and resourcefulness. Exploring free local events or utilizing public library resources can provide engaging pastimes without the cost burden. Finding discounted activities online allows for enjoying hobbies without financial strain. The key is discovering fulfilling activities that offer personal enjoyment and community involvement within a budget.

Characteristics of a Frugal Lifestyle

- Focus on needs over wants by prioritizing value.

- Implement budgeting techniques to monitor spending.

- Adopt smart grocery shopping habits to reduce costs.

- Reduce utility expenses through conscious energy use.

- Engage in budget-friendly entertainment activities.

Benefits of Embracing Frugality

Living a frugal lifestyle presents numerous advantages beyond financial savings. It fosters a sense of financial security and independence. Adopting frugality allows individuals to allocate resources towards what truly matters, such as personal growth or family time. The mental clarity achieved from reduced financial stress enhances overall quality of life, promoting a balanced and content living experience.

Additionally, frugality supports long-term financial goals by strengthening investment capabilities. Saving resources in the present opens opportunities for future investments, creating a safety net for unexpected circumstances. The discipline learned from managing finances efficiently cultivates resilience and adaptability in facing life’s challenges. These skills are invaluable assets in ensuring a sustainable future.

Embracing a frugal lifestyle promotes sustainable living through resource conservation and waste reduction. It encourages a minimalist approach, focusing on quality over quantity, reducing environmental impact. By prioritizing needs clearly, frugality leads to a conscious use of resources, minimizing unnecessary consumption. This mindful living approach dramatically impacts individual and global resource management strategies.

The ethos of frugality aligns with maintaining a purposeful and fulfilling lifestyle. It allows individuals to focus on their passions or hobbies without the burden of financial limitations. Exploring the DIY route for home projects or creative outlets fosters satisfaction and cost savings. The joy and sense of accomplishment from personal creativity can enhance life experiences remarkably.

Learning and applying frugal living principles empowers personal finance control. Developing financial awareness leads to pragmatic decision-making, aligning with personal values and aspirations. Frugality is more than a strategy; it’s an attitude of resilience and intentionality. As a lifestyle choice, it not only improves financial health but holistically enriches every aspect of life, leading to ultimate financial freedom.

- Increases financial security and independence.

- Facilitates resource allocation towards personal and family priorities.

- Supports mental well-being through reduced financial stress.

- Strengthens long-term investment opportunities.

- Promotes sustainable and eco-friendly living practices.