Frugal Living: Top 10 Hacks to Save Money in the USA

Anúncios

Settling into life in the United States can be both thrilling and financially daunting. In bustling cities, the cost of living often climbs steeply. However, this doesn’t mean one must sacrifice comfort for savings. With strategic planning, anyone can enjoy a fulfilling lifestyle without breaking the bank. From the hustle of New York to the sunny vibes of Los Angeles, smart financial tactics can substantially ease financial stress whilst maintaining quality of life.

Given America’s diverse landscape, there are countless opportunities to apply cost-saving measures in daily life. Whether it’s discovering budget-friendly entertainment or adjusting transportation habits, these strategies can help mitigate expenses. By embracing a few creative hacks, locals and newcomers alike can transform their financial experience. We aim to guide you through some effective approaches that maintain lifestyle satisfaction, regardless of budget constraints.

Future financial security is often built on small, everyday decisions. The following tips are tailored to help you navigate through common expenses like groceries, utilities, transport, and entertainment. These practical suggestions will not only preserve your pocket but also enrich your life in the vibrant expanse of the US. So, let’s dive into these hacks and optimize your saving potential while living in this diverse and dynamic nation.

Anúncios

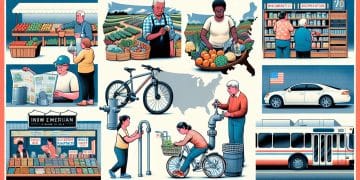

Maximize Grocery Savings

Food shopping is a fundamental aspect of life; however, the costs can be surprisingly high. Many Americans struggle with rising grocery bills. By adopting smart strategies, it’s possible to cut these costs significantly.

Price matching is a simple yet effective method. By comparing prices online and presenting them at your chosen store, one can ensure they’re getting the best deal. Meanwhile, digital coupons and store loyalty cards can also provide significant discounts on everyday items.

Buying in bulk is another valuable tactic. Stores like Costco offer products in large quantities, representing substantial savings. Non-perishable goods and household essentials are ideal to purchase in bulk, making your dollar stretch further over time. Maximizing savings in grocery spending requires diligence and planning but yields worthwhile results.

Anúncios

Control Utility Expenditure

Utilities such as electricity and water can represent a hefty portion of monthly expenses. Implementing some simple changes can lead to noticeable savings. Energy efficiency is key. Investing in smart thermostats and remembering to switch off lights and unplug devices can cut costs.

Water conservation is equally beneficial. Small adjustments like fixing leaks promptly and installing low-flow gadgets can lead to significant savings. Reducing water waste, along with mindful energy usage, minimizes monthly expenses over time. Sustainability and thriftiness often go hand-in-hand.

Transportation Efficiency

Transport needs, whether commuting by car or public transit, can significantly affect your budget. Joining a carpool or using rideshare services can reduce gas and maintenance costs. Apps provide convenient platforms for sharing rides.

Public transportation passes offer savings over single fares. Many cities have discounted rates for students or frequent travelers. Evaluating transportation needs and exploring flexible options is key to reducing these essential costs while maintaining convenience and accessibility.

Characteristics of Budget Living

- Strategic grocery shopping: price matching, using coupons, and buying in bulk.

- Utility management: investing in smart devices and promoting water conservation.

- Transportation savings: using carpooling, rideshare apps, and public transport passes.

- Entertainment on budget: utilizing community events and choosing streaming over cable.

Benefits of Smart Financial Strategies

By adopting cost-effective living strategies, significant financial benefits emerge. Not only do savings add up over time, but these practices foster a sense of financial empowerment and resilience in fluctuating economic environments.

Practicing these hacks encourages responsible spending habits, which is crucial for long-term fiscal health. Reducing unnecessary expenses paves the way for stronger savings and emergency funds, bringing peace of mind. This financial stability creates a supportive foundation for pursuing personal and professional goals without the burden of debt or worry.

Flexibility in budgeting also opens opportunities for investment and growth, expanding financial knowledge. Additionally, cost-saving practices contribute positively to environmental conservation by reducing waste and optimizing resource use.

Considerations:

- Monitor and optimize regular expenses consistently.

- Encourage sustainable practices for environmental and financial benefits.

- Incorporate savings into personal growth and investment plans.

- Foster a proactive approach to budget management.

By making mindful financial choices, life in the US becomes not only enjoyable but also financially rewarding and secure. These practices shift the focus from sacrifice to smart spending.