Saving for Homeownership: A 3-Year Plan for a 20% Down Payment

Anúncios

Saving for a 20% down payment in three years may seem daunting, but it’s achievable with a strategic approach involving setting clear financial goals, creating a detailed budget, automating savings, and exploring additional income streams, all tailored to your personal financial situation.

The dream of owning a home is a powerful motivator. However, the reality of saving for a sizable down payment, especially a homeownership dreams: saving for a 20% down payment in 3 years, can feel overwhelming. But with careful planning and disciplined execution, this ambitious goal is within reach.

Anúncios

Setting Realistic Homeownership Goals

Before diving into the specifics of saving, it’s crucial to establish realistic homeownership goals. This involves understanding your current financial situation, researching the housing market, and determining what you can realistically afford.

Assessing Your Current Financial Situation

Start by taking a detailed look at your income, expenses, debts, and assets. Knowing where your money is going will help you identify areas where you can cut back and save more effectively.

Anúncios

Researching the Housing Market Locally

Explore different neighborhoods and property types in your desired area. Understanding the average home prices will help you determine the amount you’ll need for your down payment.

Determining Affordability and Budget

Consider factors beyond the down payment, such as property taxes, homeowner’s insurance, potential maintenance costs, and mortgage payments. Use online calculators to estimate your potential monthly costs and to assist in better understanding your budget.

- Estimate your potential monthly housing costs.

- Factor in property taxes and insurance.

- Consider potential maintenance expenses.

- Use online calculators to determine affordability.

Establishing realistic homeownership goals isn’t just about the numbers. It’s about aligning your aspirations with your financial capabilities, ensuring that your journey to homeownership is sustainable and responsible.

Creating a Detailed Savings Budget

A fundamental component of saving for a down payment is constructing a detailed savings budget. A budget maps out every income and expense, therefore allocating funds towards your homeownership goal and effectively tracking your progress.

Tracking Income and Expenses

Employ budgeting apps, spreadsheets, or even traditional notebooks to log every dollar that comes in and goes out. This will give you a comprehensive view of your spending habits.

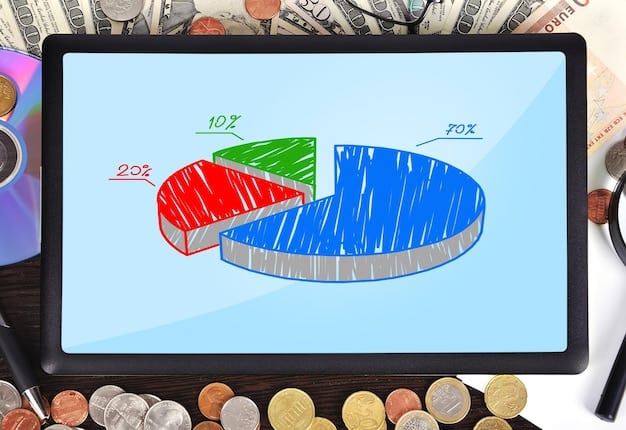

The 50/30/20 Rule and How it Can Help

The 50/30/20 rule allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust this ratio to prioritize your savings goal. For example, consider allocating 30% or 40% to savings.

Identifying Areas to Cut Back

Scrutinize your discretionary spending. Dining out, entertainment, and subscriptions are good places to start. Small sacrifices can add up to significant savings over time.

- Track your income and expenses meticulously.

- Use budgeting apps or spreadsheets for clarity.

- Adjust the 50/30/20 rule to boost savings.

- Identify and cut back on non-essential spending.

Creating a detailed savings budget is the cornerstone of your 20% down payment goal. By meticulously tracking your finances and making informed spending decisions, you can pave the way for the big step of homeownership.

Automating Your Savings Process

One of the most effective ways to save consistently is to automate the process. Automation helps avoid impulse spending and ensures that a portion of your income goes directly to your savings account.

Setting up Automatic Transfers

Arrange for a portion of your paycheck to be automatically transferred to a dedicated savings account each pay period. Treat this transfer as a non-negotiable bill.

Utilizing High-Yield Savings Accounts

Take advantage of high-yield savings accounts (HYSAs). These accounts offer significantly higher interest rates compared to traditional savings accounts, allowing your savings to grow faster.

Tools and Apps for Automated Saving

Explore apps and tools that round up your purchases and automatically invest the difference or transfer small amounts to your savings account regularly. These tools make saving effortless.

Automating your savings process is not just about setting up transfers; it’s about building a streamlined and efficient saving system. By leveraging technology and being proactive, you can set your savings on autopilot.

Exploring Additional Income Streams

Boosting your income is a powerful way to accelerate your down payment savings. Exploring additional income streams can help you reach your goal faster and provide a financial cushion.

Freelancing and Side Hustles

Consider freelancing, consulting, or starting a side hustle in your area of expertise or passion. Platforms like Upwork and Fiverr can connect you with potential clients.

Selling Unused Items

Declutter your home and sell items you no longer use, such as clothes, electronics, or furniture. Online marketplaces and consignment stores are great options.

Investing for Growth

Explore low-risk investment options to potentially earn additional income. Consult a financial advisor to determine the investments that align with your risk tolerance and financial goals.

- Freelance or start a side hustle related to your interests.

- Sell unused items through online marketplaces.

- Explore low-risk investment opportunities for growth.

- Consult a financial advisor for personalized advice.

Exploring additional income streams doesn’t have to be a daunting task. By tapping into your skills, resources, and interests, you can significantly boost your savings potential and make your down payment goal more attainable.

Optimizing Your Credit Score

A strong credit score not only improves your chances of mortgage approval but also secures better interest rates, saving you money over the life of the loan. Optimizing your credit score is important while saving for a down payment.

Understanding Credit Score Factors

Familiarize yourself with the factors that influence your credit score, such as payment history, credit utilization, length of credit history, credit mix, and new credit. Focus on improving areas where you’re lacking.

Paying Bills on Time

Make all your payments on time, every time. Payment history is the most significant factor in your credit score.

Keeping Credit Utilization Low

Keep your credit card balances low relative to your credit limits. Aim to use no more than 30% of your available credit on each card.

Focusing on improving your credit score is not just about meeting a minimum threshold; it’s about positioning yourself for the best possible mortgage terms. By taking proactive steps to build and maintain your creditworthiness, you can save significantly on your home purchase.

Staying Disciplined and Tracking Progress

Saving for a down payment over three years requires consistent effort and unwavering discipline. Tracking your progress keeps you motivated and allows you to make necessary adjustments along the way.

Regularly Reviewing Your Budget

Schedule regular reviews of your budget to ensure it still aligns with your savings goals. Reassess your income, expenses, and savings targets to make adjustments as needed.

Celebrating Milestones

Acknowledge and celebrate each milestone you reach, no matter how small. This positive reinforcement helps you stay motivated and committed to your goal.

Adjusting Strategies as Needed

Be flexible and willing to adjust your strategies as circumstances change. Life throws curveballs, so be prepared to adapt your approach to stay on track.

- Review your budget regularly for alignment.

- Celebrate milestones for positive reinforcement.

- Stay flexible and adjust strategies as needed.

- Visualize your goal and stay committed.

Staying disciplined and tracking progress is not just about the numbers; it’s about maintaining a positive mindset and a clear focus on your ultimate goal: homeownership. By staying vigilant and adaptable, you can overcome challenges and achieve your desired outcome.

| Key Point | Brief Description |

|---|---|

| 🎯 Set Goals | Establish realistic homeownership goals. |

| 💰 Budget | Create a detailed savings budget. |

| 🏦 Automate | Automate your savings process. |

| 📈 Credit | Optimize your credit score. |

Frequently Asked Questions

▼

The amount you need to save each month depends on your target down payment and your timeline. Divide the total down payment amount by 36 (months) to get an estimated monthly savings goal.

▼

A high-yield savings account (HYSA) is typically the best option because it offers a higher interest rate than a standard savings account, allowing your money to grow faster.

▼

Consider freelancing, starting a side hustle, selling unused items, or exploring low-risk investment options to generate additional income and accelerate your savings efforts.

▼

Yes, but prioritize paying off high-interest debt first. Reducing your debt burden will free up more cash for savings and improve your credit score, making you a stronger mortgage applicant.

▼

Explore options like lower down payment mortgages (e.g., FHA loans), down payment assistance programs, or extending your savings timeline. Consult with a mortgage advisor for guidance.

Conclusion

Saving for a 20% down payment in three years is an ambitious but achievable goal. By setting realistic targets, budgeting effectively, automating your savings, boosting your income, optimizing your credit score, and staying disciplined, you can turn your homeownership dreams into reality. The key is consistency, adaptability, and a clear vision of your goal.